Rigetti Computing’s latest earnings call felt less like a financial report and more like a status update from a deep-space probe. On one channel, we hear the faint, crackling signal of current operations—revenue, earnings, the mundane metrics of business. On the other, a clear, booming broadcast of a glorious future, filled with thousand-qubit systems and computational power that could reshape industries.

The problem, for anyone trying to build a valuation model, is that the two signals are telling completely different stories.

The Q3 numbers were, to put it charitably, mixed. As reports like RGTI Earnings: Rigetti Computing Posts Mixed Financial Results detailed, the company posted an adjusted loss of three cents per share, which managed to beat Wall Street’s consensus estimate of a four or five-cent loss. This is the kind of “good news” that gets a polite, single-clap reception. It’s a win, but a win defined by losing less money than anticipated.

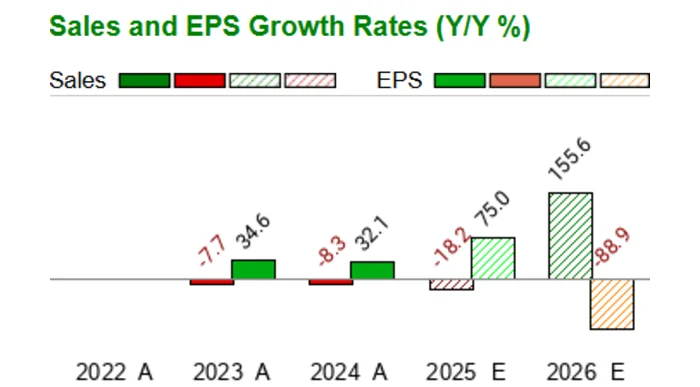

The far more telling metric was revenue. It came in at $1.94 million, missing analyst forecasts of $2.17 million. More importantly, it represents a decline from the $2.37 million Rigetti booked in the same quarter last year. And this is the part of the report that I find genuinely puzzling. For a company at the bleeding edge of a revolutionary technology, a company whose CEO claims "strong momentum," how does top-line revenue go backward? Is the demand for on-premises quantum computers, a key talking point, so lumpy that it creates these negative growth quarters? Or is the current addressable market for their technology simply smaller and less developed than the stock's narrative suggests?

The Great Disconnect

This brings us to the heart of the matter: the profound disconnect between Rigetti’s current financial state and its stock's behavior. The stock has been on a wild ride, more than tripling from early September to its mid-October peak before giving back a substantial portion of those gains. This isn’t the price action of a company grinding out incremental progress. It’s the signature of a market trading on a story, a dream.

That dream is the technology roadmap. Management remains confident, projecting a 100-plus qubit system by the end of 2025, a 150-plus qubit system by 2026, and the big prize—a 1,000-plus qubit system by 2027. These aren’t just product updates; they are promises of exponential leaps in capability. This forward-looking narrative is what fueled the speculative fire, fanned by whispers of government interest (including a quickly contradicted report of a potential Trump administration investment).

Investing in a company like Rigetti right now is like funding a 16th-century expedition to find El Dorado. The potential prize is a city of gold, a paradigm shift in computing. But the map is a sketch, the technology is unproven at scale, and the journey is fraught with peril. The stock’s recent volatility shows investors trading furiously over the perceived value of the map itself, with its price spiking on rumors of a royal charter and plummeting when the explorers report they’re running low on supplies. The actual proximity to gold is, for now, almost a secondary concern.

The analyst consensus reflects this tension. A "Moderate Buy" rating with five Buys and two Holds seems to hedge its bets. The average price target of $32, which at the time of the report implied potential downside, suggests even the bulls are having a hard time justifying the stock’s more speculative altitudes. These ratings are less a reflection of Q3 performance and more a bet on the 2027 roadmap.

A Question of Faith and Physics

So, what is an investor to make of this? Rigetti is burning cash, its revenue is small and shrinking, and its valuation is tethered to technological milestones that are still years away. The company’s ability to narrow its losses is commendable from a fiscal discipline standpoint (a key focus for CEO Dr. Subodh Kulkarni), but it doesn’t solve the fundamental issue. A quantum computing company cannot save its way to success. It must invent its way there.

The core challenge is that the market is applying the logic of a software-as-a-service (SaaS) company—where you can track monthly recurring revenue and customer acquisition costs—to a deep-tech, hard-science problem. We don’t know what the "killer app" for a 1,000-qubit machine will be, nor do we know what the total addressable market for it looks like. We can’t even be certain Rigetti will be the one to build it first, or if their chosen architecture will be the one that ultimately wins.

You can almost picture a trader, eyes glued to a screen, watching the stock price gyrate. The flicker of green and red has nothing to do with the quiet, painstaking work happening in a lab, where physicists are trying to coax quantum bits into a state of stable coherence. The market is playing a game of momentum and sentiment, while the company is playing a game of physics and engineering. The two are running on completely different timelines.

A Bet on Physics, Not Financials

Ultimately, analyzing Rigetti through the lens of a single earnings report is like judging the outcome of a marathon by the first 100 meters. The numbers we saw in Q3—the $1.94 million in revenue, the three-cent loss—are almost background noise. They don’t tell you if the company’s chiplet-based architecture will scale, or if they will achieve the 99.5% fidelity they’re aiming for. Owning this stock isn't an investment in a business as it exists today. It is a high-risk, venture-capital-style bet that Rigetti's physicists and engineers can solve some of the hardest problems on the planet, and do it on schedule. The financials will only start to matter if, and when, they do.